TaxAdmin.AI

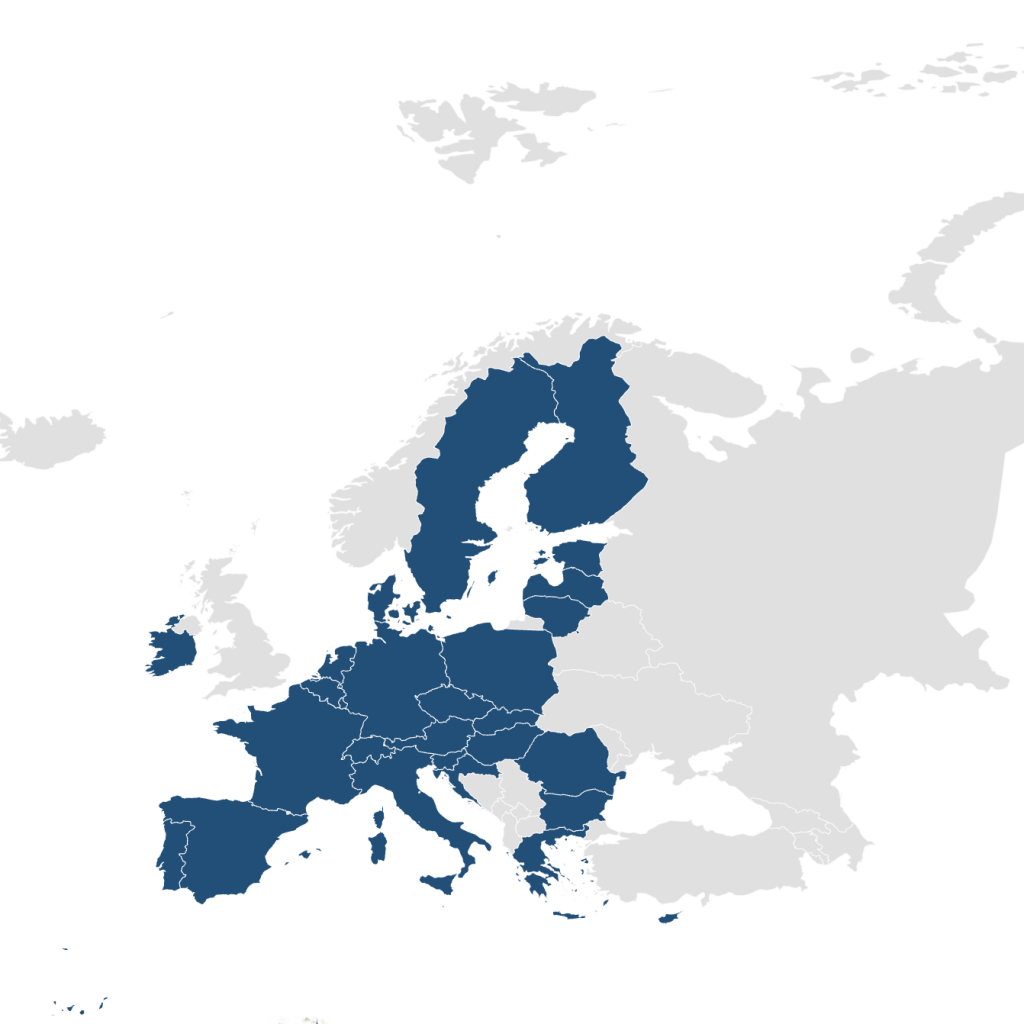

Open-access repository of the use of AI by tax administrations in the EU

Antwerp Center On Responsible AI

Our mission

TaxAdmin.AI is an open-access repository, compiling artificial intelligence algorithms used by tax authorities in the EU. The goal of TaxAdmin.AI is to inform citizens on the algorithms used to assist, surveil and profile taxpayers.

The website follows a citizen-science approach, allowing every visitor to contribute to this research by reporting useful additional or new information.

Should you have information on other AI tools used by tax administrations, contact us.

Transparent information on algorithms of the tax administration

The TaxAdmin.AI team performs regular sweeps through the internet, and publicly documented use of AI by tax administrations: what functions they perform, what taxpayer data is processed, whether these are regulated by specific norms, and what are the consequences for taxpayers.

Upon identification of a new AI system, we publish the system in the EU Overview and in the individual country reports.

Systems identified are classified in a functional taxonomy, and placed into one of the following categories:

- Taxpayer assistance: systems meant to automate assistance voluntarily requested by taxpayers, such as chatbots to answer tax queries

- Nudging: systems that attempt to ensure compliance without exercising coercion, such as friendly alerts during tax filing or adaptive communication

- Data collection: systems that automate taxpayer surveillance, such as scraping and crawling systems

- Risk detection: systems that detect signals or indication of potential fiscal misconduct

- Risk-management: systems that attribute a score to taxpayers, deciding who to control and/or what treatment strategy is best for each taxpayer

- Internal assistance: systems meant to assist tax officials for non-coercive actions, such as information management, jurisprudence analyses or search queries

Explore our content

EU Overview of AI tax algorithms

Individual Country Reports

Publications

frequently asked questions

We are here to help!

Consult our FAQ to find an answer to the most popular topic clusters and questions asked by our users.

Did not find what you were looking for? Contact us!

TaxAdmin.AI is the project of David Hadwick, PhD researcher at the DigiTax Centre of Excellence of the University of Antwerpen (Belgium) and PhD Fellow in legal fundamental research at the Research Foundation for Flanders (FWO). David is a member of the Antwerp Centre for Responsible AI (ACRAI) and the Antwerp Tax Academy (ATA).

David Hadwick carries research on the use of technology by tax administrations, at the intersection of law, technology and public governance. His current research: ‘Deus Tax Machina: The use of AI by tax administrations and its implications for taxpayers‘ fundamental rights in the EU‘ maps the use of tax machine-learning algorithms in the EU, and examines the consequences of such use on taxpayers’ rights.

TaxAdmin.AI is a citizen-science repository compiling all AI/machine-learning algorithms used by tax administration in EU Member States.

The goal of the website is to provide EU citizens with an easy-to-use exhaustive database of the machine-learning algorithms used by tax administrations.

In doing so, TaxAdmin.Ai hopes to educate citizens on the use of technology by tax administrations and promote transparency over an important but otherwise relatively unknown topic.

TaxAdmin.AI regularly performs ‘sweeps’ through the internet, and systematically analyse content which makes references to cases of AI/machine-learning algorithms used by EU tax authorities.

This can be literature of the OECD, IOTA, CIAT or incidental reports in national or local newspapers.

After having identified algorithms, we compile them in our EU Overview and in our Country Reports.

TaxAdmin.AI is a citizen-science repository, which follows a citizen-science approach where every visitor to contribute to this research by reporting useful additional or new information.

Should you have information on other AI tools used by tax administrations, feel free to contact us and we will publish your information on the website.

Anyone with documented sources on the use of AI by tax administrations, in any language, can share it with us and actively contribute to the TaxAdmin.AI project.