Functional overview of the use of AI:

An important question in regulatory discourse on the use of AI is: ‘what are the functions performed by these systems?’

This is the first question in our country reports as it is the primary determinant of the risks of conflict with taxpayers’ rights. Machine learning can be used as much for coercive or cooperative purposes, depending on the function designated.

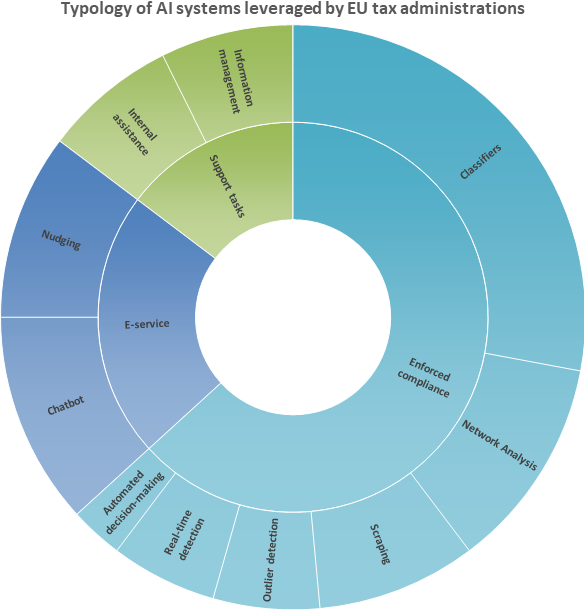

As shown on the chart below, tax administrations make use of machine-learning for a wide array of purposes.

When examining the use of AI per function, we can observe that out of the more than 80 systems identified in our dataset:

- 25% are risk-scoring classifiers

- 20% are risk detection systems

- 10% are scraping and automated data collection systems

- 20% are used for information management and internal assistance

- 17% are systems for taxpayer assistance

- 7% are nudging tools

By aggregating the data in a functional taxonomy, we observe that a quarter of the AI systems (24%) are used to assist taxpayers. A fifth of all AI systems used by EU tax administrations are used for internal purposes, primarily for information and database management.

A little over half of all AI systems of tax administrations are used for compliance stricto sensu, to detect non-compliance and select taxpayers for audit. This shows that AI is not only ubiquitous, but in a number of cases can be a win-win for the administration and for taxpayers, for instance with the different chatbots answering tax queries.

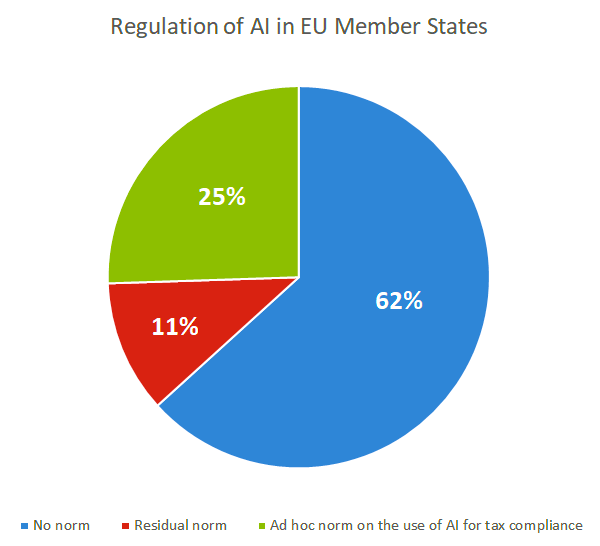

How many AI systems of EU tax administrations are regulated by specific legislation?

As stated in our publications on SyRI and eKasa, jurisprudence on the use of AI by tax administrations is univocal on the fact that AI systems cannot be regulated by residual norms of tax procedure, which were designed prior to the use or even existence of the technology.

AI systems used by tax administrations generate specific risks of conflict with taxpayers’ rights, which can only be mitigated by custom-made legislation. Hence, the question of whether AI systems of tax administrations are regulated by ad hoc legislation is of particular importance to assert compliance with taxpayers’ rights.

As shown in the chart below, very few Member States have adopted specific norms to regulate the use of AI by tax administrations. Only 7 out of 27 Member States (25.9%) have adopted norms regulating the use of AI by tax administrations.

What tax administrations exhibit the highest maturity in the use of AI systems?

Based on publicly-available data, the tax administrations with the highest degree of maturity in the use of AI systems presently are:

- AEAT (Spain): the highest number of AI systems detected in publicly-available sources was in Spain. Moreover, the AEAT had the highest number of functionalities in the taxonomy of AI systems.

- SPF Finances (Belgium) & Belastingdienst (the Netherlands): These two agencies had the second highest number of AI systems detected in publicly-available sources. Almost every functionality of the taxonomy was represented with the exception of chatbots. Moreover, both agencies designed systems that were later on used by other revenue agencies, respectively XENON for the Belastingdienst and TNA for the SPF Finances.

- Skatterverket (Sweden): The Swedish Agency had the third highest number of AI systems detected, and every functionality represented on the taxonomy.